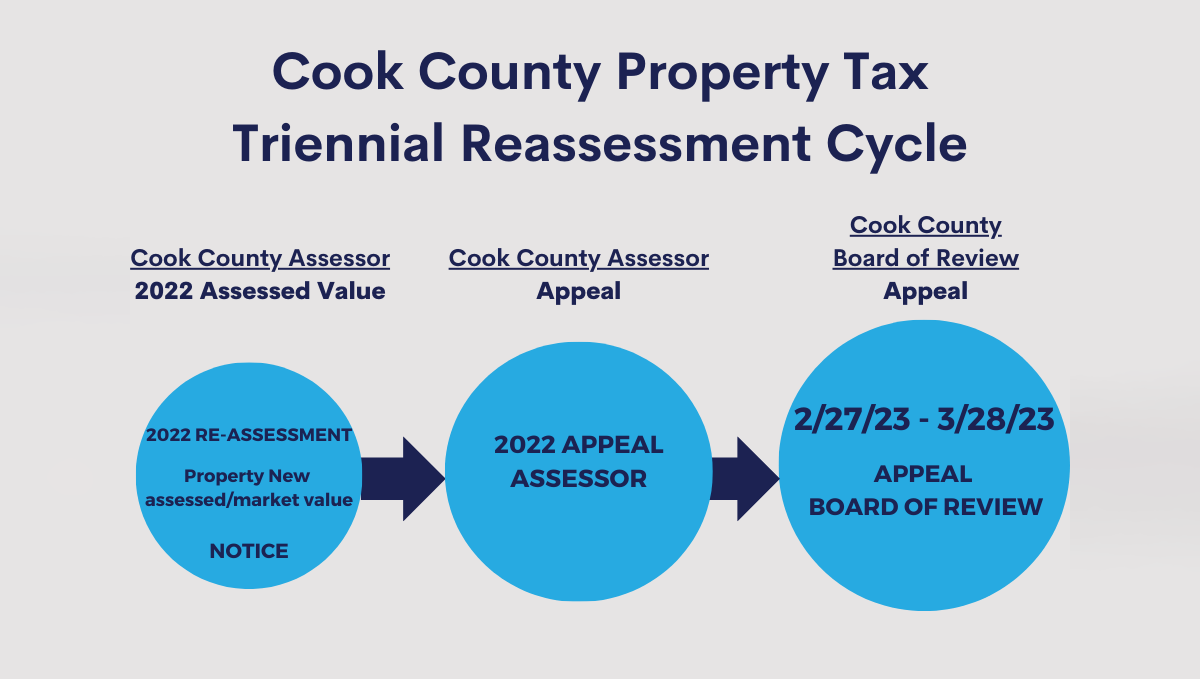

Cook County Board of Review Property Tax Appeal February 27 – March 28

If Northfield Township residents missed their chance to appeal their 2022 property assessed value with the Cook County Assessor, there is another opportunity to file an appeal with the Cook County Board of Review (BOR), if helpful.

Northfield Township can review residents’ assessments to be sure they are equitable and can assist with filing an appeal if helpful.

The Board of Review is a separate, quasi-judicial agency independent of the Assessor. The Cook County Assessor sets the taxable value on all of the more than 1.8 million parcels of real estate located in Cook County. When each township reassessment is completed by the Assessor, property owners may appeal the assessment set by the Assessor at the Board. The Board decision sets the final county valuation on the property for that tax year.

There are 3 ways the Township can assist you with your appeal:

- Email us at: propertytaxhelp@northfieldtownship.com with your address or property index number (PIN). We can review your assessed value and send you comparable data to use in an appeal if helpful, along with a guideline on how to appeal online.

- You can schedule an in-person or telephone appointment to review your assessment here: tinyurl.com/assessorBOR.

- You can call our office at (847)724-8300 x2.